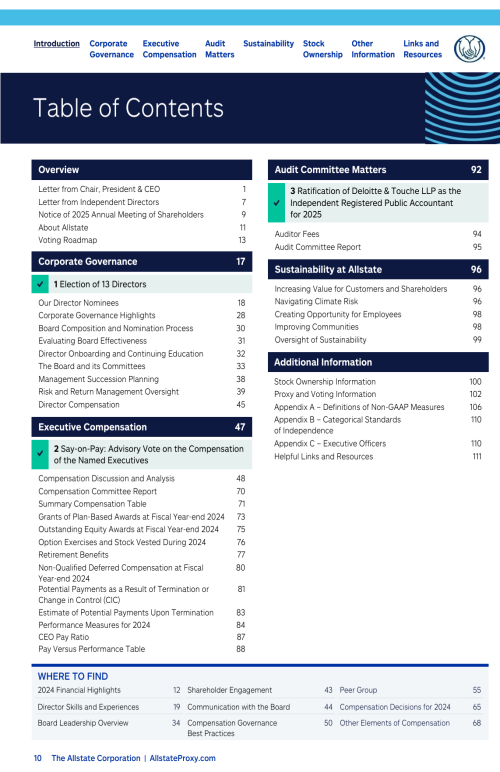

Index

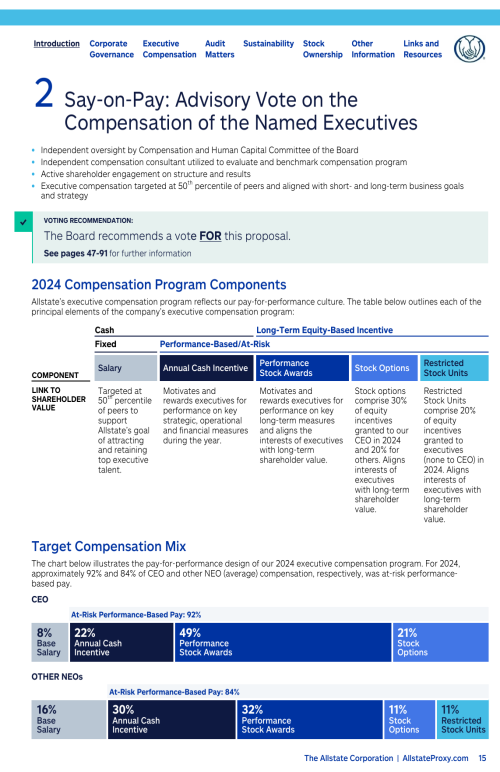

Proposal 2 Say-on-Pay: Advisory Vote on the Compensation of the Named Executives

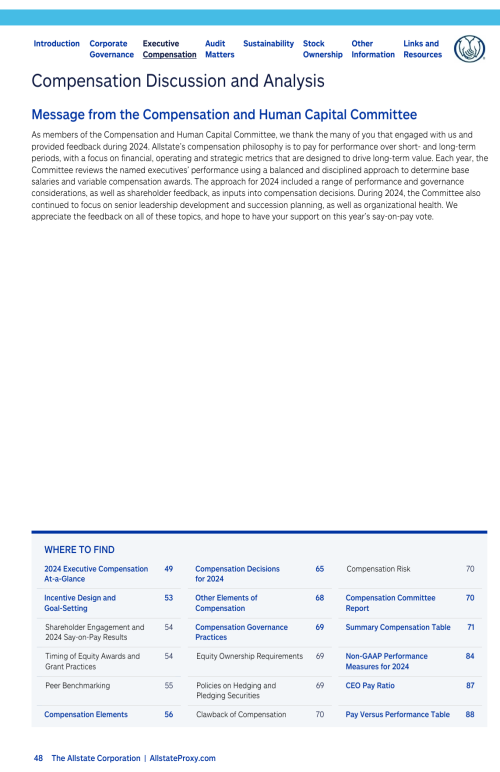

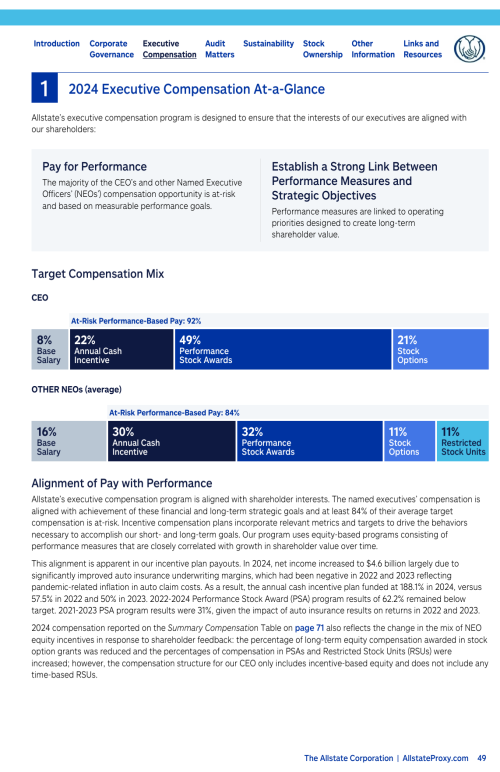

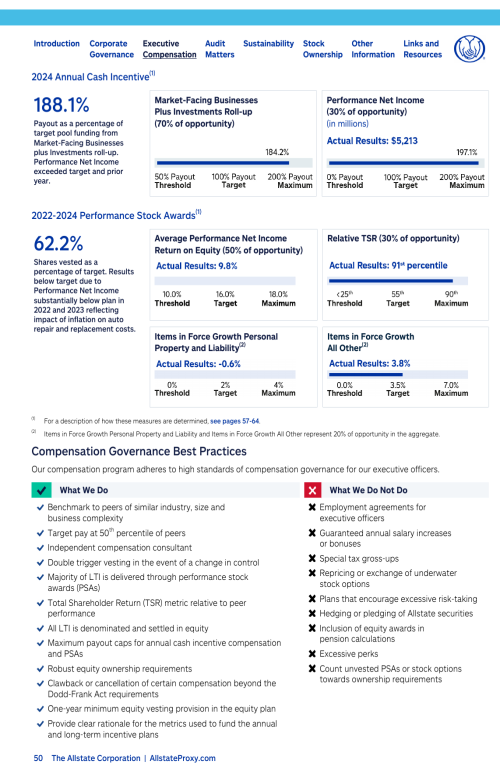

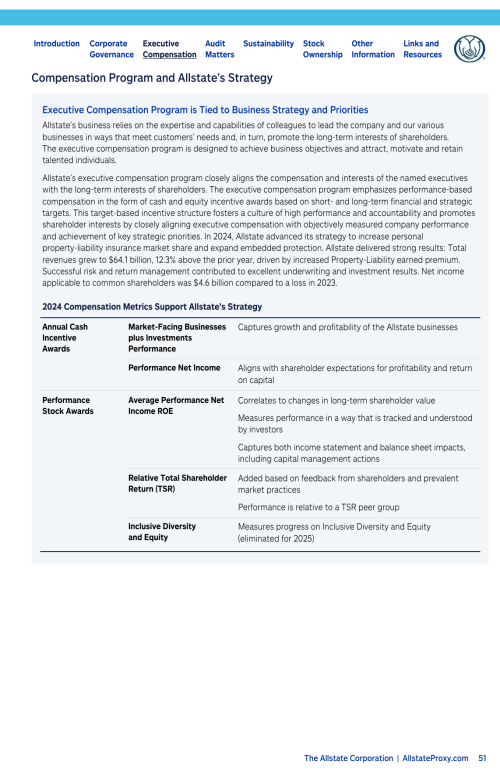

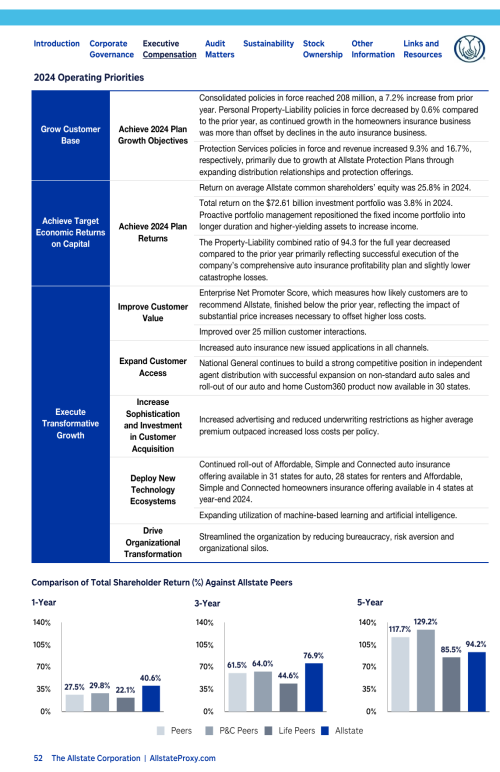

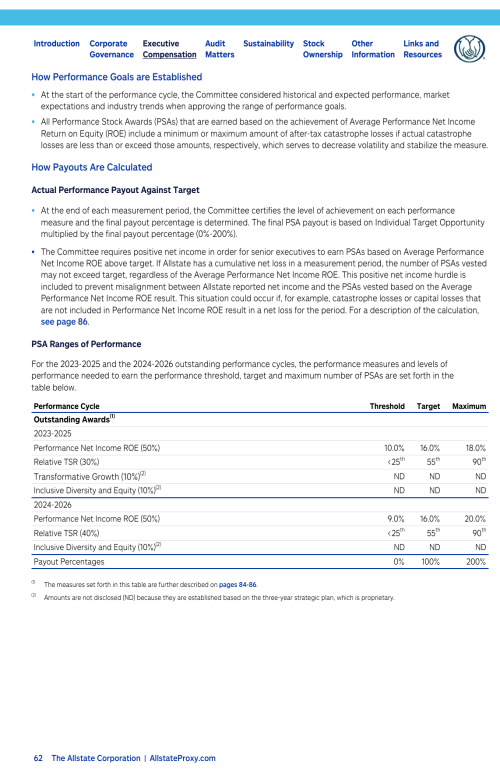

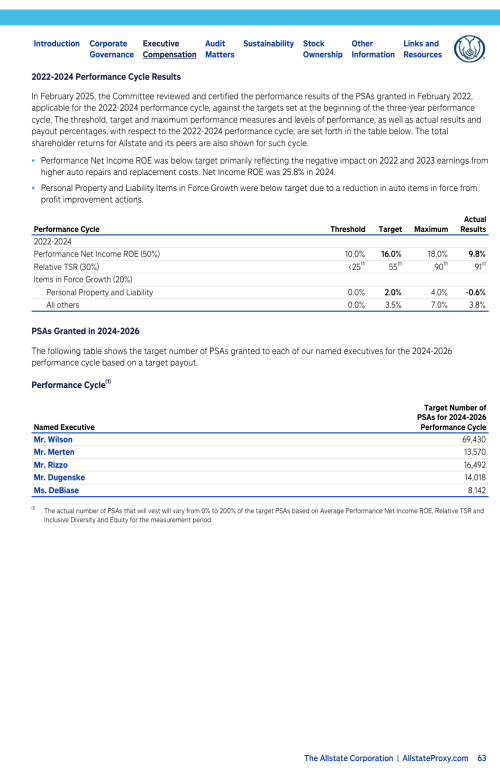

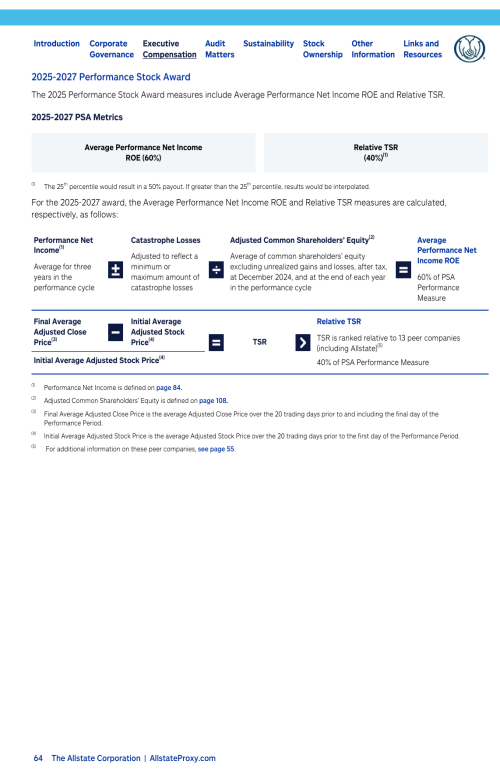

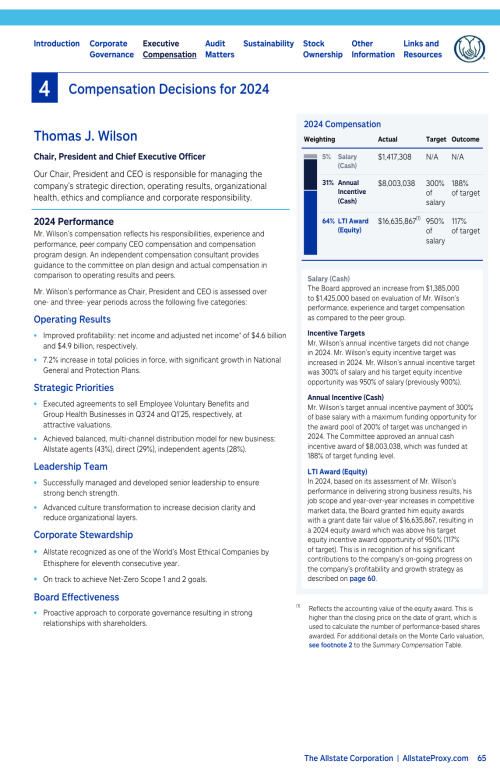

Compensation Discussion and Analysis

Compensation Committee Report

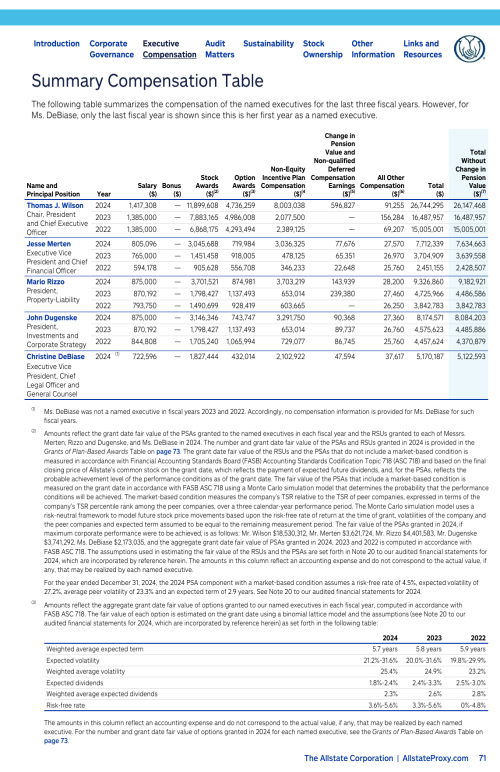

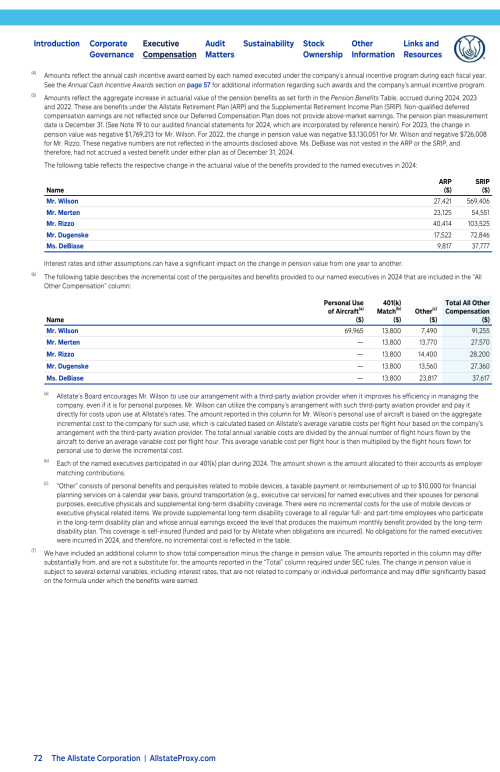

Summary Compensation Table

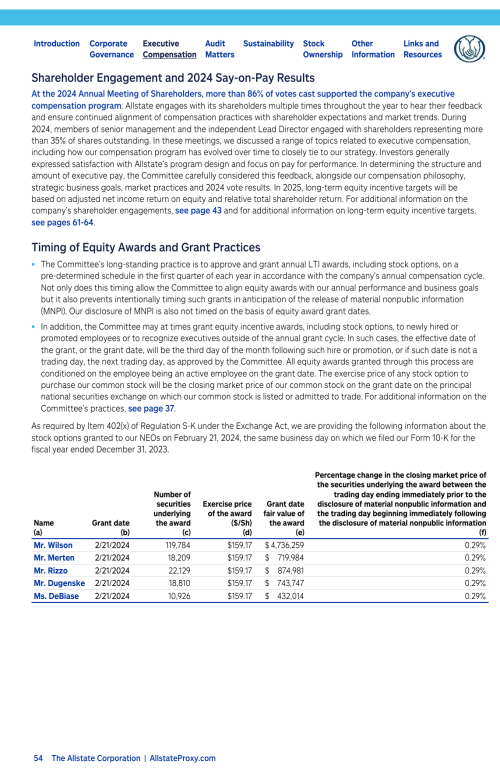

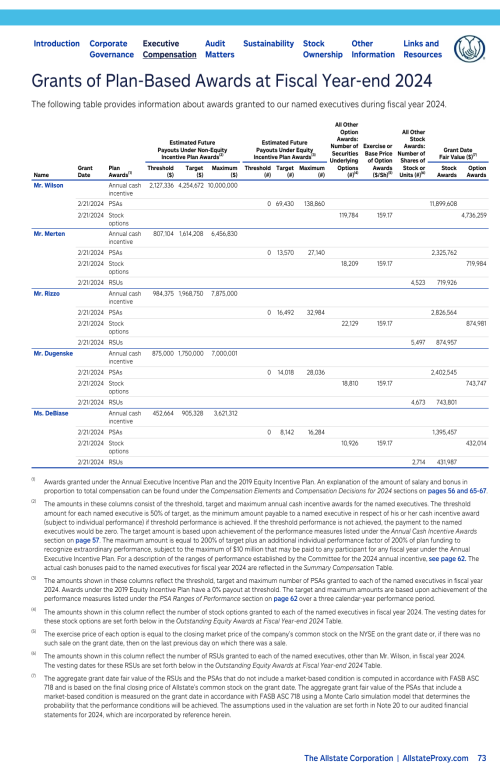

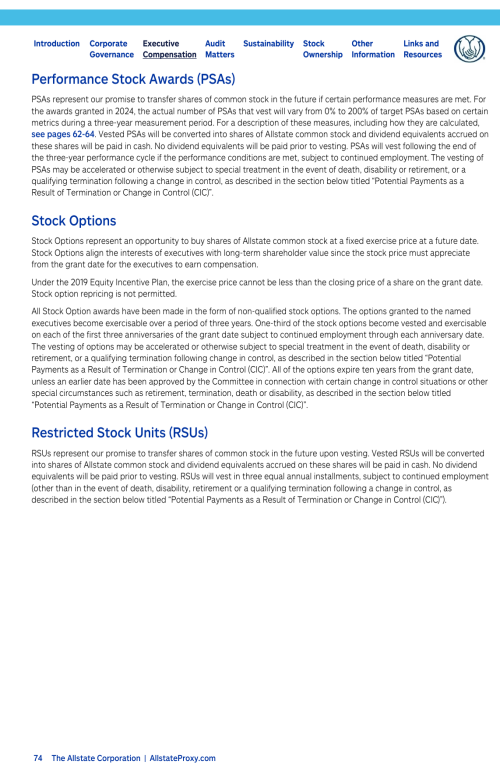

Grants of Plan-Based Awards at Fiscal Year-end 2024

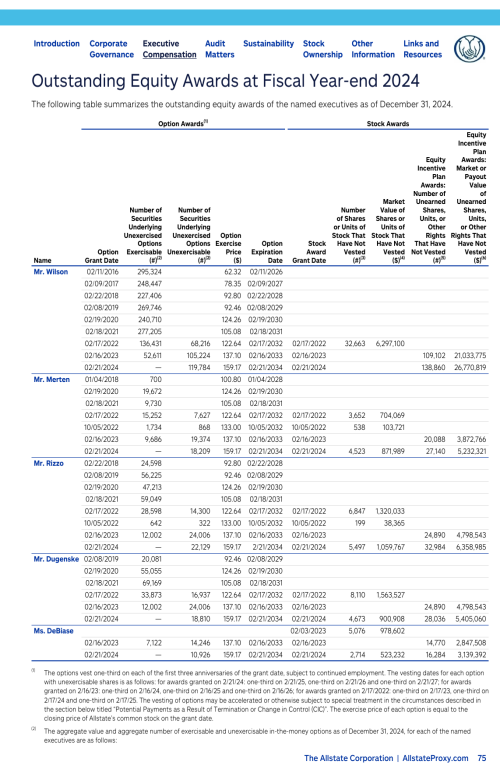

Outstanding Equity Awards at Fiscal Year-end 2024

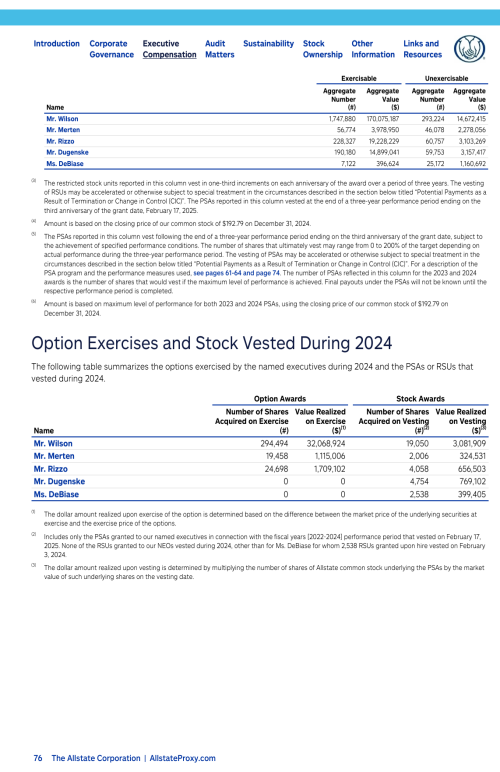

Option Exercises and Stock Vested During 2024

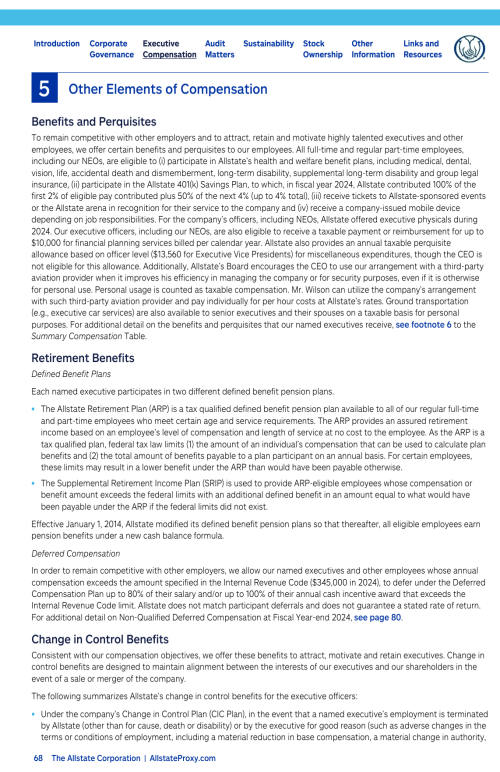

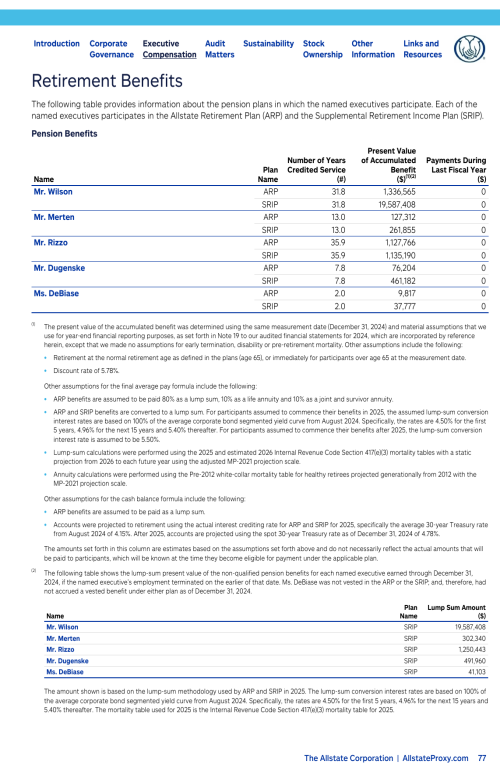

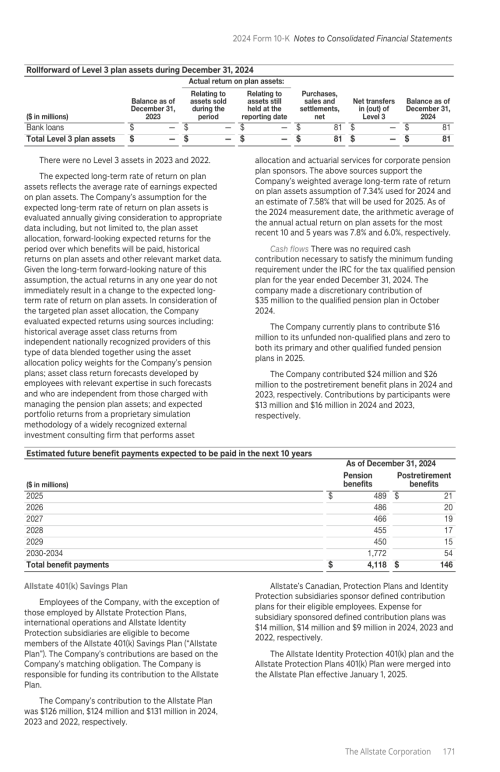

Retirement Benefits

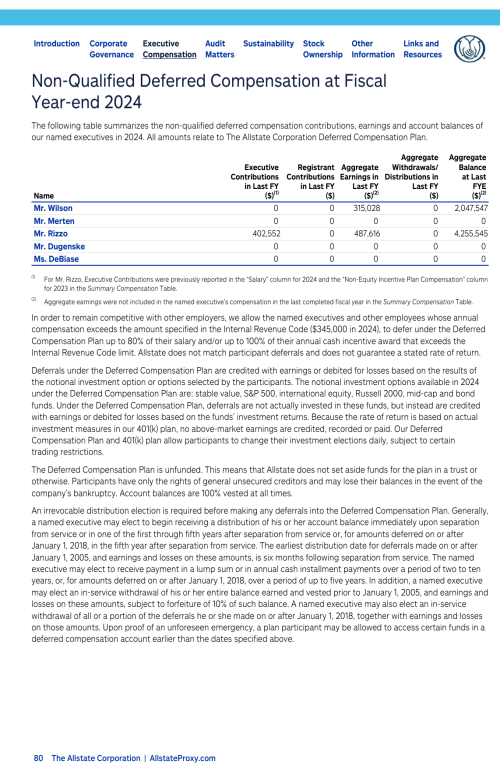

Non-Qualified Deferred Compensation at Fiscal Year-end 2024

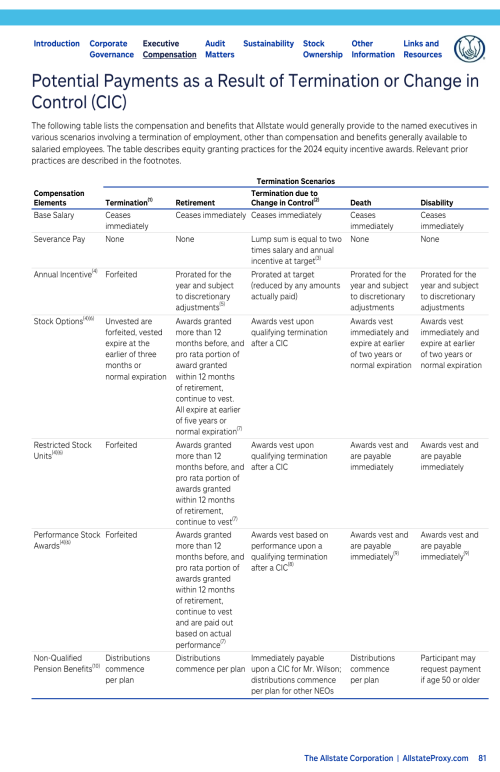

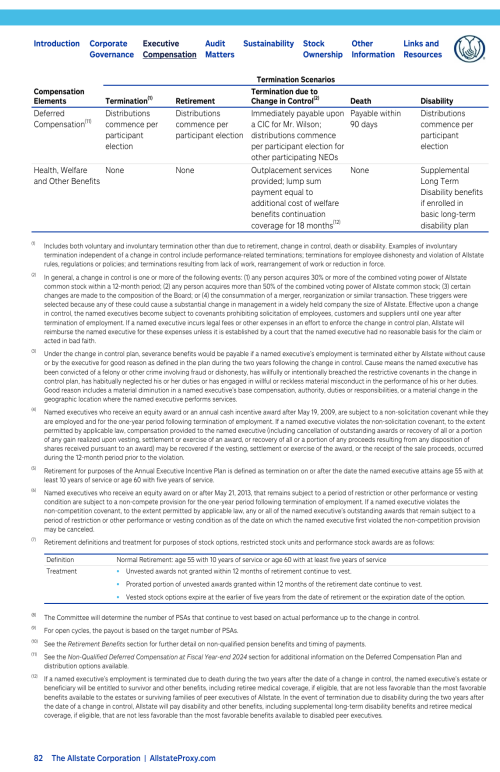

Potential Payments as a Result of Termination or Change in Control (CIC)

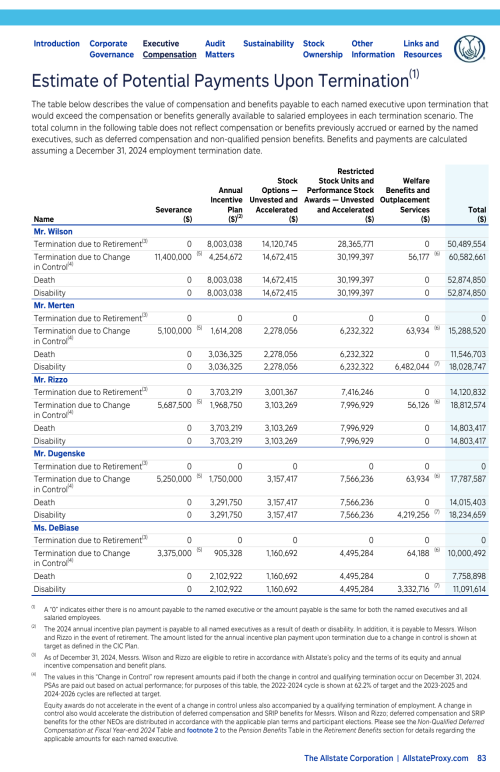

Estimate of Potential Payments Upon Termination

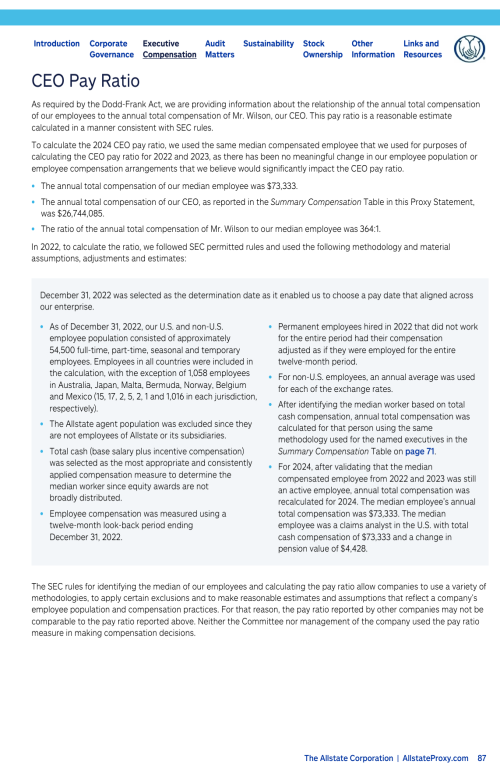

CEO Pay Ratio

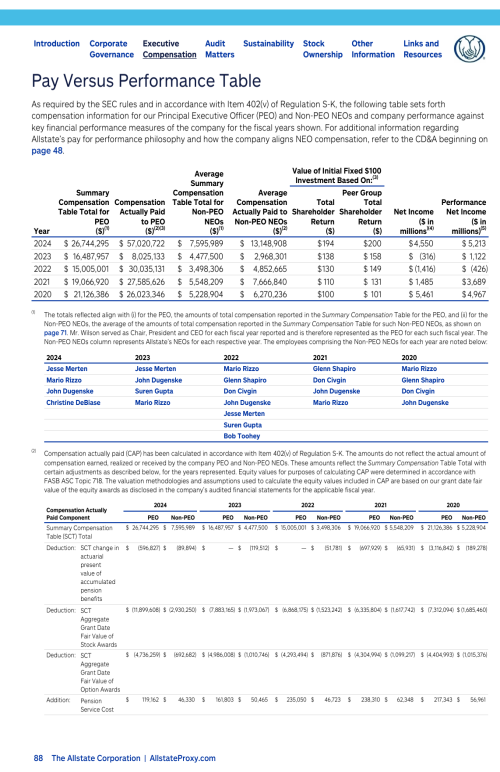

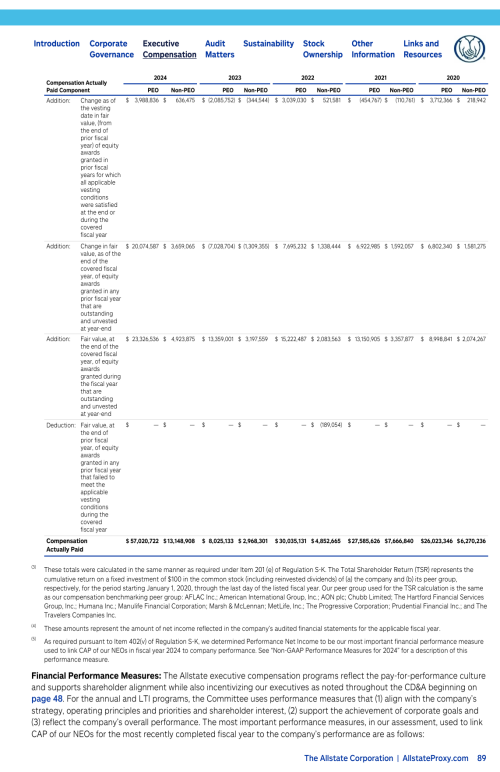

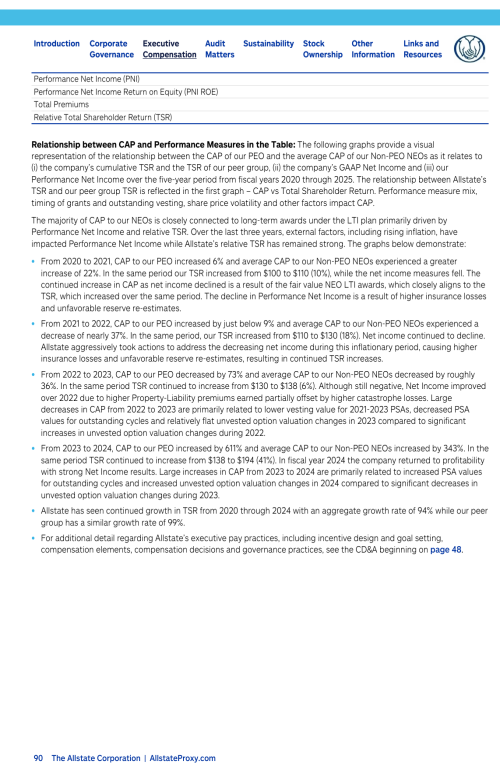

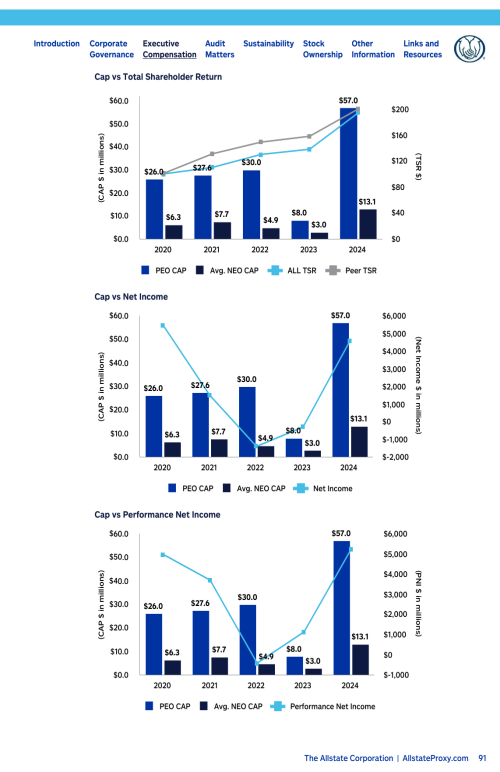

Pay Versus Performance Table

Pages

Search

Index

Proposal 2 Say-on-Pay: Advisory Vote on the Compensation of the Named Executives

Compensation Discussion and Analysis

Compensation Committee Report

Summary Compensation Table

Grants of Plan-Based Awards at Fiscal Year-end 2024

Outstanding Equity Awards at Fiscal Year-end 2024

Option Exercises and Stock Vested During 2024

Retirement Benefits

Non-Qualified Deferred Compensation at Fiscal Year-end 2024

Potential Payments as a Result of Termination or Change in Control (CIC)

Estimate of Potential Payments Upon Termination

CEO Pay Ratio

Pay Versus Performance Table